| Who looks after this policy: | Head of Housing |

| Who approved it: | Leadership team |

| When was it last reviewed: | May 2021 |

| When is the next review: | May 2024 |

1. Introduction

This policy sets out the principles and the overall approach we take to collect rent, service charges and other payments, prevent arrears, manage arrears and ensure that effective and appropriate action is taken to maximise income and reduce debt. The policy applies to all properties owned and managed by B3Living, including properties let on tenancies, licenses and leases.

A separate Income Management Strategy includes detailed procedures implementing this policy.

This policy applies to all properties owned and managed by B3Living, including properties let on tenancies, licenses and leases.

The policy covers charges levied to current customers and debt owed by former customers, including:

1. Rent – a payment amount, fixed by a tenancy/license agreement, by which a tenant is liable to pay at specified intervals in return for the right to occupy or use a dwelling or garage.

2. Service charges - Charges paid by customers for services provided by B3Living in connection to property or tenancy. The charges relate to costs incurred for the day to day upkeep of communal areas and for the longer-term maintenance of relevant communal areas and buildings.

3. Sundry charges such as administration costs, court fees and recharges for repairs that are the occupier’s responsibility and costs levied to customers for any other services.

3.1 Income management activity is identified as a corporate priority, as effective

income and arrears management is crucial to operate B3Living as a viable

business due to the charges levied to customers being our main source of

revenue income.

3.2 Maximising income enables us to provide excellent customer services,

maintain and improve our property assets and develop much needed new

homes. Without adequate financial resources our ability to provide added

value services such as welfare and debt advice and other support to help

customers sustain their tenancies is hampered.

3.3 Most importantly, an effective income management ethos not only prevents

customers from falling into unnecessary or significant debt but ensures that

they can sustain tenancies and reduce their chances of becoming homeless.

3.4 This policy is designed to achieve the following outcomes:

► Collect all rent and charges due (how charges are determined is set out in

the Rent Setting Policy)

► Promote a payment culture to all customers

► Develop a culture of trust between B3Living so that customers feel able to

contact us early on if they are in danger of being unable to make payments

► Proactively prevent and minimise arrears.

► Aligned with our customer ethos value to deliver a personalised and inclusive

service, treat customers as individuals and respond to their differing needs to

help them to sustain tenancies, pay charges and reduce arrears

► Identify, control and recover debt promptly with a fair and sympathetic but

firm approach to deal with customers who have arrears

► Ensure robust and systematic procedures for collecting debt from former

tenants

► Ensure systems, processes and performance management measures are in

a place to demonstrate implementation of this policy

3.5 We will deliver the following key objectives to implement this policy. A detailed Income Management Framework will provide further guidance and procedures to achieve and monitor the impact of the actions.

The objectives are to:

3.6.1 Collect all rent and charges due

1. Provide comprehensive information to customers so that they

understand how B3Living sets rents, service charges and other charges

2. Offer wide-ranging payment methods and flexible payment options to

make it easy for customers to pay

3. Encourage take up of easy and speedy payment methods

4. Provide account statements at least annually and when customers

request it

5. Ensure systematic use of procedures and protocols to implement this

policy

3.6.2 Promote a payment culture to all customers

1. Provide clear and accessible information and advice in order to

prevent arrears and legal action from occurring

2. Encourage customers to self-monitor by checking their rent and service

charge accounts frequently and regularly

3. Implement B3Living’s policy of advance rent payment from new

tenants, reinforce the terms of the tenancy/license/lease and the

importance of paying rent in advance and making regular payments

4. Proactively publicise to customers the importance of regarding rent

and service charges as ‘priority debts’ and serious consequences of

non-payment

3.6.3 Develop a culture of trust between B3Living so that customers feel able to

contact us early on if they are in danger of getting into arrears

1. Signpost customers to specialist agencies, where appropriate, so that

they can promptly complete and submit welfare benefit applications

2. Use customer data and other insight to identify tenants who are or in

danger of becoming vulnerable and provide targeted support

3. Publicise the availability of support from B3Living staff and external

agencies for welfare benefits and debt management

4. Actively encourage customers to take ownership of any difficulties with

non-payment of Housing Benefit or Universal Credit

5. Consider individual circumstances and set up realistic repayment

arrangements and options for customers in arrears and encourage self-monitoring

3.6.4 Proactively prevent and minimise arrears:

1. Make income management ‘everyone’s business for B3Living

employees, so that they are able to identify when a customer maybe

struggling financially and signpost them to the Rent Team for support

and guidance

2. Make income and arrears work a priority for Housing Management

Services, including regular monitoring of accounts and taking prompt

action for non-payers and customers who do not keep to arrear clearance agreements

3. Consider rent payment campaigns with an emphasis on the effects of

non-payment

3.6.5 Treat customers as individuals and respond to their differing needs to help

them to sustain tenancies, pay charges and reduce arrears

1. Treat people with respect and discuss debt issues in a confidential

setting

2. Protect, support and signpost vulnerable people

3. Consider individual circumstances and set up realistic repayment

arrangements and options for customers in arrears and encourage self-monitoring

4. Work with relevant agencies to develop a mutually supportive working

relations with the aim of helping people to remain or become

financially included

5. Honour any reasonable agreement made to discharge debts before escalating legal action

3.6.6 Identify, control and recover debt promptly with a fair and sympathetic but

firm approach to deal with customers who have arrears

1. Effectively manage every account in line with this policy and

associated procedures

2. Progress a staged approach based on the extent of arrears and debt

period

3. Constructively engage with customers as soon as they fall into arrears to

control and reduce debt

4. Make every effort to influence the customer to get advice and support

with paying current charges and clearing arrears

5. Take speedy action to contact and engage with tenants who do not

keep to payment plans to clear their account

6. Keep the debtor informed of action being taken at every stage of the

arrears recovery process and reinforce key messages of support

available and consequences of continued non-payment

7. Work with relevant external partners to prevent homelessness and

consider alternatives to evictions

8. Where someone is at risk of homelessness, inform the Local Authority

before an eviction takes place to continue to support the debtor and

protect vulnerable people from the risk of eviction

3.6.7 Ensure robust and systematic procedures for collecting debt from former

tenants

1. Effectively manage every former tenant account in line with this policy

and associated procedures

2. May refer former tenant debt to a debt collection agency where there

are no other options

3. Write-off debts where there is no prospect of recovery, in accordance

with B3Living’s Financial Regulations

3.6.8 Ensure systems, processes and performance management to demonstrate

implementation of this policy

1. Implement this policy with appropriate procedures that provide for

systematic and robust approaches to maximising income, minimising

debt and preventing homelessness

2. Deliver efficient and effective rent accounting processes

3. Ensure staff training and development to aid consistent

implementation and continuous improvement

4. Provide the necessary tools for staff to carry out their tasks effectively

5. Set targets and measurable outcomes from the work of individual officers

and monitor performance

6. Measure and benchmark performance and share experience and

best practice with peer landlords

7. Introduce systematic data insight to understand reasons for non-payment.

We will apply our income management policy consistently and fairly. We do not

discriminate against any person on grounds of their age, disability, gender

reassignment/transgender, marriage or civil partnership, pregnancy or maternity,

race, religion or belief, sex, sexual orientation or any other matter that may cause a

person to be treated with injustice.

The needs of vulnerable customers where this affects their ability to make payments will be considered on a case by case basis. We recognise that vulnerability could be caused by temporary circumstances or long-term matters.

All frontline officers will receive training on our Safeguarding procedures to ensure

that appropriate processes are followed where any safeguarding issues are

identified.

We will use plain language and make information available in different formats and

languages on request.

This policy will be operated in line with B3Living’s Data Protection and Confidentiality

Policy.

We aim to provide excellent services but recognise that we do not always get things

right.

If customers or service users are not satisfied with the way procedures for implementing this policy they can make a complaint by contacting us so that we can discuss the matter further and aim to resolve issues at an early stage. If the customer remains dissatisfied they could take up B3Living’s formal complaints procedures.

This policy complies with key legislation and the Consumer Standards published by

the Regulator of Social Housing. The specific requirements of the Regulatory

Standards are summarised as:

1. Setting rents from 1 April 2021 in accordance with the Government’s Policy

Statement on Rents for Social Housing 2018 (known as the Rent Policy

Statement)

2. Meeting the specific requirements contained in the Tenant Empowerment

and Involvement Standard in relation to providing choices, information and

communication that is appropriate to the diverse needs of tenants and

having an approach to complaints that is clear, simple and accessible so that

complaints are resolved promptly, politely and fairly.

8. Linked policies, procedures and guidance

Other B3Living policies that relate to income management policy, procedures and guidance are:

a. Rent Setting Policy

b. Lettings and allocations

c. Equality and Diversity

d. Data Protection and Confidentiality

e. Safeguarding Policy

f. Complaints Policy

9. Responsibility

All relevant employees have a responsibility to ensure that this policy is applied as intended. The roles and responsibilities of individual officers are detailed in relevant job roles.

The overall responsibilities are with (list below to be completed)

► Policy approval – Leadership Team

► Overview of performance – Executive Team

► Day to day operational responsibility – Leadership Team

► Day to day service delivery – Operational Staff

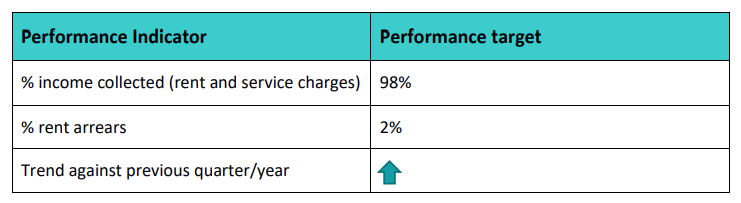

10. Performance monitoring

Summary of changes

| What changed? | When? | Who? |

| Full policy review | 13/5/21 | Sophia Howells |